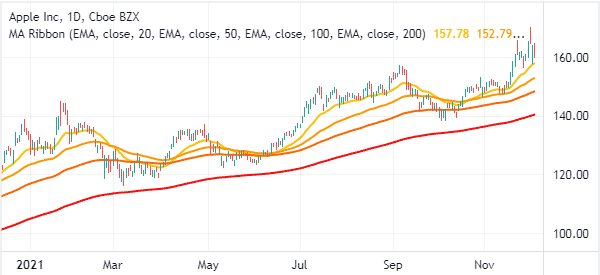

As the chart shows below the EMA begins to move clearly lower.

To use the EMA for trend trading we are waiting for a clear direction either higher or lower.

This also means we are looking for larger pip targets with larger stop losses. When trend trading with the moving average we are looking for large running trends. There are two main strategies that are normally used to find trades with the EMA. Keep in mind this is a longer term indicator set over periods that is best used to find longer term trends. This way you can either find new long running trend trades, or exit with healthy profits. The main strategy when using the EMA is identifying larger trends or looking for forex ema 150 ema 200 trends are changing. You can also use it on all time frames and markets. It has a lot of benefits and applications that you could potentially use it in your trading for. The EMA trading strategy is incredibly simple and easy to use. NOTE: If you do not yet have the correct charts make sure you read about the best trading charts and the broker to use the moving average trading strategy with here. Then, click okay and the moving average will be applied to your chart. Once you have done this a box will open up on your chart and you will be presented with some options. Setting up and using this indicator in your MT4 or MT5 charts is very simple. For example if using it on a 15 minute chart, then the EMA will be using the last periods from the 15 minute time frame. You can use this on any time frame to find trends or dynamic support and resistance. The period EMA is using the last periods of information to create a moving average on your chart. Where a simple moving average averages the price data equally for all periods, the exponential moving average has more emphasis on the recent price. The main difference between these two types of moving averages is that the exponential moving average gives more weight to the recent price. There are two popular forms of moving averages that are used. For example a day moving average is using the last days price information. The moving average is created by showing the average price over a set period of candles or time. It can also help you find dynamic support and resistance. One of the most popular and commonly used indicators and strategies is the moving average and in particular the EMA trading strategy. The stochastic indicator is used to determine oversold or overbought market ted Reading Time: 3 minsĮMA And 15 EMA crossover trading strategy If the price is below ema, the forex trend is down, and if it is above ema, it is considered an upward trend. To use this forex strategy, create charts on 3 time frames: the 4 hour, the 1 hour, the 15 minute Foreign exchange (Forex) traders use the exponential moving average (EMA) and the stochastic indicator for their scalping strategy.

200 ema indicator free#

Check Out My: Free Price Action Trading Course Many new forex traders may find it difficult to identify what the main trend is and if the market is in an Estimated Reading Time: 3 mins Dec 03, You see, with the EMA forex strategy, you are trading with the trend and buying low and selling high.

The EMA Multi-Timeframe Forex Trading Strategy is really simple and has the potential to give you hundreds of pips each month.

0 kommentar(er)

0 kommentar(er)